“Taxes can feel hard and scary at times,” said Jo Blue, manager of the University of Washington Bothell’s Health & Wellness Resource Center, “which is why the HaWRC is excited to have a resource for tax prep help.”

In a decade-long partnership with United Way of King County, students lead a tax assistance program known as VITA (Volunteer Income Tax Assistance), which is designed to help people who make $54,000 or less, have disabilities or have limited English language skills.

The program is managed by UW Bothell accounting students in the Beta Alpha Psi – Mu Psi Chapter who become tax assistance specialists certified by the Internal Revenue Service. The certification requires a minimum of 16 hours of training, passing an exam and signing a code of ethics.

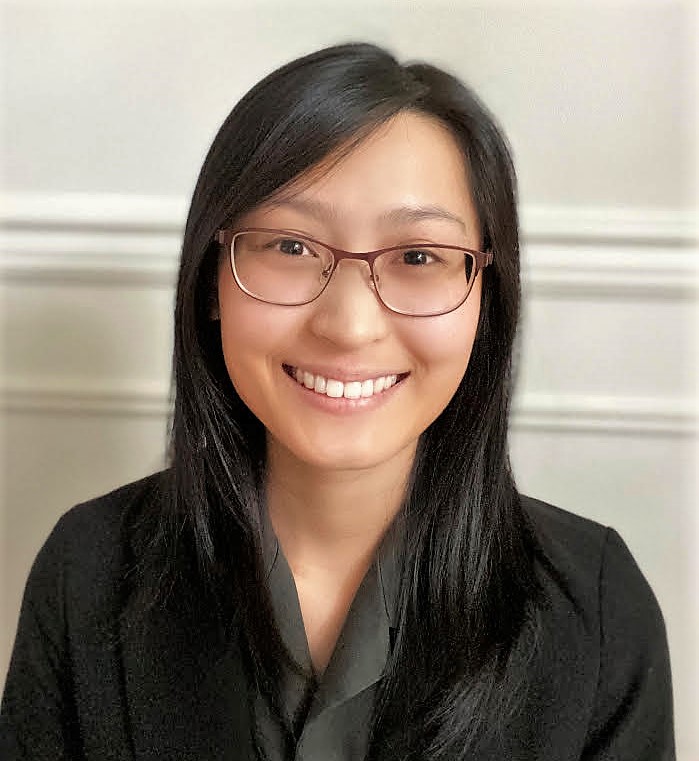

The feeling of accomplishment made all the training worthwhile, said Michelle Tan, a fourth-year Business Administration major who is studying both accounting and finance.

“Seeing the smiles on my clients’ faces is what brings me back every year,” she said. “The program offers students such an invaluable experience. Learning how to communicate directly with your clients is something a classroom setting cannot offer.

“You also have to hold yourself accountable to make sure your client’s information is protected,” Tan said. “I have grown so much both personally and professionally though participating in the program.”

COVID-19 curve balls

This is Tan’s third year as a tax preparer for VITA, but it’s the first time she is working with clients remotely. Orchideh Raisdanai, the accounting faculty adviser for the chapter and the tax program, said the pandemic has presented its own set of tax challenges.

“The filing date was changed four times. Some people didn’t file because they just didn’t know when to file,” Raisdanai said. “The economic income credit also added confusion in terms of how that tax credit is applied. There are a lot of interesting curve balls this year in helping clients.”

In prior years, the student volunteers would operate out of Founders Hall (UW1), but now the program runs through the UWKC website, which offers three different ways for people to access help.

The first is through Get Your Refund, which is where UW Bothell students volunteer. The second option is My Free Taxes, where people can file on their own. Third is the option to call 2-1-1 or visit the 211 website.

Community benefits

After only four weeks, despite the difficulties, VITA volunteers had processed returns in King County that totaled more than $1 million, said fifth-year student Gary Stevens, also a Business Administration major studying accounting and finance.

Last year, Raisdanai said, the volunteers completed 2,000 returns, which represented about 19% of UWKC’s total returns. That equated to $3.46 million dollars in tax refunds.

“One of the most wonderful things the program has been able to do is take what students learn in the curriculum and let them apply that outside the classroom,” she said. “By doing so, students are able to give back to their community using their business and accounting skills.”

Fourth-year accounting and finance student Alex Li moved from a beneficiary of VITA to being a volunteer — and is now even a VITA coordinator and program manager.

Li and his family were helped years ago, but he remembers the experience as though it were yesterday. “I was amazed by how quickly the income tax specialists handled and reviewed our tax documents and turned them into drafts,” he said.

“Because I was served by United Way of King County, I am now serving others.”